A2A Payments Transfers

What is FedNow A2A Transfers

FedNow, A2A Transfers and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank account-to-account (A2A) transfers that utilize a real-time and text messaging system connected to every transaction participant through all U.S.-based financial institutions.

FedNow, the Federal Reserve's real-time payment system, is poised to offer significant benefits for business merchants by enabling real-time, Account-to-Account (A2A) transactions. By addressing industry concerns and providing a secure environment for data sharing through open banking, merchants can fully leverage A2A transfers for receiving and making payments. Here’s why FedNow business merchants should use A2A transactions:

1. Real-Time Payment Settlements

- Instant Access to Funds: A2A transactions via FedNow allow merchants to receive payments instantly. Unlike traditional payment systems, where there is a delay in settlement (such as ACH or card payments that take 1-3 business days), FedNow ensures immediate availability of funds, improving cash flow and enabling better financial management.

- No Waiting Periods: Real-time payments eliminate the need to wait for funds to clear, which is particularly valuable for businesses needing liquidity for day-to-day operations. Whether it’s paying suppliers or managing payroll, the availability of instant funds is a game-changer.

2. Cost Savings on Transaction Fees

- Lower Processing Costs: A2A transfers typically bypass the fees associated with card transactions (such as interchange fees) and intermediary banking systems. For FedNow business merchants, this translates into significant cost savings over time, especially for businesses handling large volumes of payments.

- No Need for Card Networks: With FedNow, merchants can receive payments directly from customers’ bank accounts, avoiding the need for third-party card networks. This not only saves on fees but also reduces the complexity of managing various payment processing systems.

3. Enhanced Data Security

- Secure Environment: Open banking ensures that customer data is shared securely using encrypted and regulated APIs. Merchants using FedNow for A2A transactions can rely on these advanced security protocols, which minimize the risk of data breaches and protect sensitive financial information.

- Fraud Reduction: By using A2A transactions, merchants can lower the risk of fraud, as payments are directly linked to bank accounts. Open banking’s strong authentication methods (such as multi-factor authentication and biometrics) provide an extra layer of protection for both merchants and customers, reducing the chances of unauthorized transactions.

4. Increased Transparency and Control

- Real-Time Transaction Tracking: With A2A payments through FedNow, merchants benefit from full visibility into the payment lifecycle. They can track transactions in real time, enhancing transparency and allowing for immediate reconciliation.

- Simplified Payment Management: Direct A2A transfers make it easier for merchants to manage incoming and outgoing payments. Whether it’s supplier invoices, payroll, or refunds, businesses can streamline their payment workflows, ensuring a smooth and efficient operation.

5. Frictionless Customer Experience

- Convenient Payment Process: For customers, A2A transactions provide a seamless experience, as they can authorize payments directly from their bank accounts without needing to input card details or deal with third-party payment gateways. This can result in a quicker and smoother checkout process, improving customer satisfaction.

- Instant Payment Confirmation: Real-time payment confirmations via FedNow help customers know immediately when their payment has been successfully processed. This transparency builds trust and confidence in the business, reducing customer inquiries or concerns about payment status.

6. Eliminating Chargebacks and Disputes

- Reduced Chargebacks: Credit card payments can be subject to chargebacks, which often create disputes and administrative burdens for merchants. A2A transfers through FedNow remove this issue, as payments are directly authorized by the payer and are irrevocable once made, minimizing the chances of chargebacks or disputes.

- Fewer Payment Reversals: Because the payments are real-time and authorized directly by the customer, there are fewer issues related to reversals or failed transactions. This reduces uncertainty for merchants and ensures that payments are final.

7. Fostering Trust through Open Banking

- Customer Data Control: With open banking, customers have greater control over who can access their financial data, and they authorize each transaction directly. This builds trust, as customers feel more secure sharing payment information through regulated open banking platforms rather than traditional payment networks.

- Secure API Integration: Open banking allows merchants to securely integrate with banks and financial institutions through standardized APIs. These APIs ensure that sensitive payment data is encrypted and transferred securely, adhering to regulatory requirements.

8. Greater Financial Inclusion

- Accessibility for All: A2A payments enable businesses to tap into a broader customer base, including those who may not have credit cards but have bank accounts. With FedNow, merchants can easily accept payments from any U.S. bank account, ensuring more customers have access to their services, which enhances financial inclusion.

- No Dependency on Card Networks: Many consumers may be underbanked or prefer not to use credit cards. By offering A2A payment options through FedNow, merchants can serve customers who rely on bank accounts for payments without needing to depend on card network infrastructure.

9. Regulatory Compliance and Data Privacy

- Complying with Standards: Open banking operates under stringent regulatory standards that protect customer data and ensure transparency in financial transactions. Merchants using FedNow for A2A transactions can be assured that they are adhering to these regulations, reducing compliance risks and ensuring data privacy.

- PSD2 and U.S. Equivalents: While PSD2 is a European directive, the U.S. is developing its own open banking frameworks. Merchants can prepare by adopting FedNow and open banking standards early on, ensuring they stay compliant as regulations evolve.

10. Future-Proofing Payment Infrastructure

- Adapting to the Future of Payments: With the rise of digital payments and real-time banking, merchants who adopt FedNow and A2A transactions position themselves at the forefront of payment innovation. They can stay ahead of the competition by offering faster, more secure, and more cost-effective payment options.

- Integration with Emerging Technologies: As technologies like AI, machine learning, and blockchain become more integrated with the financial system, merchants using A2A transactions and FedNow will be in a strong position to adopt new payment innovations more quickly and effectively.

Conclusion

By using A2A transactions through FedNow, business merchants can benefit from faster payments, reduced costs, enhanced security, and improved customer satisfaction. Open banking ensures that these benefits are delivered within a secure, transparent, and regulated environment, driving forward the adoption of real-time payments for FedNow, Real-Time Payments (RTP), and ACH systems. Merchants who embrace this payment revolution can streamline their operations, improve their cash flow, and provide a superior experience for their customers.

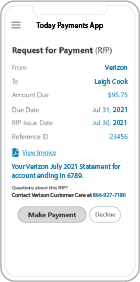

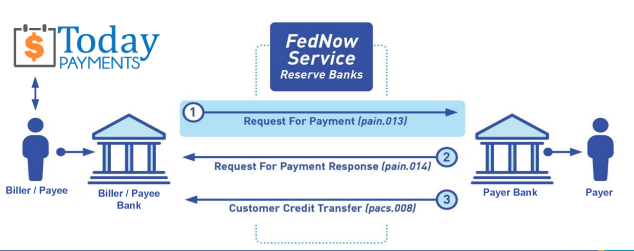

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory .csv or .xml data for completed ISO 20022 file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our A2A Transfers system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing